In Olympia, WA, effective estate planning combines robust asset protection strategies with legal tools like trusts and liability-shielding entities. This tailored approach, coupled with optimized insurance policies, safeguards wealth, enhances tax efficiency, and ensures financial security for current and future generations. Olympia's unique economy demands proactive estate planning to navigate legal and tax environments successfully, maintain control over financial futures, and preserve assets from risks and liabilities. Local professionals utilize tools like living trusts to distribute assets according to individual wishes while complying with Washington state regulations. Personalized strategies tailored to Olympia residents' financial states and goals offer long-term security, growth, and legacy preservation, protecting against liabilities and uncertainties.

“In the competitive landscape of Olympia, WA, effective estate planning is not just an option—it’s a strategic necessity. This article delves into the intricacies of high-performance asset protection strategies tailored for residents of Olympia, WA. We explore why robust estate planning is crucial, dissecting the legal framework within Washington State, and offering insights on creating bespoke plans for optimal results. Discover how to secure your future and ensure your assets thrive.”

- Understanding Asset Protection Strategies

- The Importance of Estate Planning in Olympia, WA

- High-Performance Asset Protection: A Comprehensive Approach

- Legal Framework and Regulations in Washington State

- Creating a Tailored Plan for Optimal Results

- Benefits and Long-Term Security for Your Future

Understanding Asset Protection Strategies

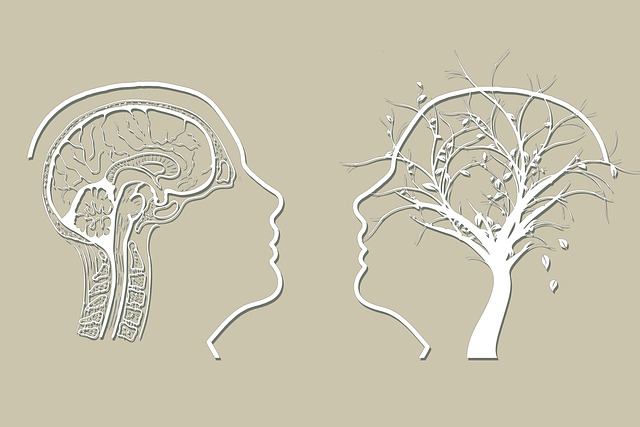

In the realm of Olympia WA estate planning, understanding asset protection strategies is paramount for individuals seeking to safeguard their hard-earned wealth. These strategies involve a range of legal and financial tools designed to protect assets from potential risks, liabilities, and unforeseen events. By employing such measures, residents can ensure their prosperity is preserved for current and future generations.

Asset protection planning in Olympia WA goes beyond simple savings or investments. It encompasses techniques like establishing trusts, utilizing liability shielding entities, and implementing comprehensive insurance policies. These strategies not only protect assets but also enable efficient wealth transfer while minimizing tax implications. Understanding these methods empowers individuals to make informed decisions tailored to their unique financial situations.

The Importance of Estate Planning in Olympia, WA

Estate planning is an essential aspect of securing your financial future and ensuring your assets are protected. In Olympia, WA, where a diverse range of individuals and families call home, having a well-structured estate plan can make all the difference in managing one’s wealth effectively. With its vibrant economy and beautiful natural surroundings, Olympia offers a unique environment for residents to thrive, but it also presents various challenges when it comes to asset protection.

By implementing comprehensive Olympia WA estate planning strategies, individuals can safeguard their assets, manage potential risks, and ensure their wishes are carried out according to their preferences. This process involves careful consideration of tax implications, legal requirements, and personal goals, allowing for a tailored plan that addresses the specific needs of each client. Efficient estate planning can help protect against unforeseen circumstances, ensure smooth transitions of wealth, and maintain control over one’s financial legacy in the beautiful city of Olympia.

High-Performance Asset Protection: A Comprehensive Approach

In Olympia, WA, high-performance asset protection planning is not just about preserving wealth; it’s a comprehensive strategy to safeguard your hard-earned assets and secure your financial future. This involves careful consideration of various legal tools and strategies tailored to your unique circumstances. By employing sophisticated estate planning techniques, such as trusts, business structures, and advanced tax planning, high-performance asset protection ensures that your resources are shielded from potential risks, liabilities, and unforeseen events.

Olympia’s dynamic economy and competitive landscape necessitate a proactive approach to asset protection. A well-crafted plan accounts for both personal and business assets, offering peace of mind and financial stability. It enables individuals and businesses to navigate complex legal and tax environments efficiently, making it an indispensable tool for those seeking to maintain control over their financial destiny in the vibrant community of Olympia, WA.

Legal Framework and Regulations in Washington State

In Olympia, WA, estate planning is a critical aspect of ensuring your assets are protected and distributed according to your wishes. The legal framework in Washington State provides a robust structure for individuals to create comprehensive asset protection plans. The state has specific regulations that govern wills, trusts, and other estate-related matters, offering both flexibility and clarity for residents.

Washington’s laws prioritize the integrity of estate planning documents, ensuring they are valid and enforceable. This includes requirements for witnessing and notarization of signatures on wills and trust agreements. Additionally, the state offers various tools like living trusts, which can help protect assets from legal claims, tax liabilities, and potential future financial uncertainties. Olympia WA estate planning professionals leverage these legal frameworks to design tailored strategies that safeguard clients’ assets while considering both local and federal regulations.

Creating a Tailored Plan for Optimal Results

In the competitive world of asset protection, a one-size-fits-all approach simply won’t do for residents of Olympia, WA. Creating a tailored estate planning strategy is essential to achieving optimal results and safeguarding your hard-earned assets. This involves a thorough understanding of your financial situation, goals, and the unique legal landscape in Washington state. By collaborating with experienced professionals, you can design a comprehensive plan that addresses specific challenges and leverages available tools to protect your wealth.

From identifying at-risk assets to implementing protective measures like trusts and business structures, each aspect of your estate planning should be carefully considered. A strategic approach ensures that your financial future is secured while maximizing the potential for growth and preserving your legacy in Olympia, WA.

Benefits and Long-Term Security for Your Future

High-performance asset protection planning in Olympia, WA offers significant benefits and ensures long-term financial security for your future. By strategically structuring your estate, you can protect your hard-earned assets from potential liabilities and uncertainties. This proactive approach allows you to maintain control over your wealth while minimizing legal and tax risks.

In the ever-changing landscape of asset protection, Olympia WA estate planning plays a pivotal role in safeguarding your financial well-being. It provides peace of mind knowing that your loved ones are taken care of, and your assets are protected from potential claims or lawsuits. With careful planning, you can ensure that your legacy is preserved for future generations, allowing them to benefit from your prosperity without the burden of legal complications.

In conclusion, high-performance asset protection planning in Olympia, WA, is not just about safeguarding your wealth; it’s a comprehensive strategy that ensures your financial future remains secure and vibrant. By understanding the importance of estate planning within Washington State’s legal framework, you can create a tailored plan that offers long-term security and benefits for you and your loved ones. Olympia WA Estate Planning should be a top priority for anyone seeking to protect their assets and ensure a seamless transition during their lifetime or beyond.